Someone asked about my old blog…..

Mostly, I post in a magazine called Free Beeswax

But, it might be time to add some posts here.

Anyway, learned a lot from our service Subscription Plus.

Much more to come. Will announce as we go. Thanks.

Someone asked about my old blog…..

Mostly, I post in a magazine called Free Beeswax

But, it might be time to add some posts here.

Anyway, learned a lot from our service Subscription Plus.

Much more to come. Will announce as we go. Thanks.

Posted in Uncategorized | Leave a Comment »

The info graphic below shows a few vital things small businesses should be caring about in 2013:

If you actively plan and manage your business, these topics have likely crossed your mind. If they haven’t, they should.

Enjoy the info-graphic from auctiva, Vendio, and Alibaba and stay tuned for more from Red Crow Consulting in 2013!

Posted in Small Business | Tagged "Small Business", business, consultingPractices, executivePOV, google | Leave a Comment »

For over a year, I’ve been working with and thinking about small business. Having a mostly, large firm consulting background, it’s been a fun and interesting complement to my MBA.

I will be posting more often with shorter posts.

I’m exited to announce a new focus on small business with a new offering from Red Crow Consulting.

Keep an eye on us!

Raul Flores, Jr.

Posted in Small Business | Tagged "Small Business", announcement | Leave a Comment »

Movements in capital spending are often industry-wide occurrences and amass to very large sums. In fact, total spending on new and used structures and equipment (i.e., capital spending) by all U.S. nonfarm businesses have been around a trillion dollars annually from 1999 to 2008 according to the US Census Bureau – 2007 and 2008 are about $1.3 trillion each. Clearly, these investments are among the most scrutinized decisions in business. So, how are they made and which is best?

When it comes to making an investment decision in capital spending, there are three basic kinds of criteria as shown in the table below: 1) discounted cash flow criteria, 2) payback criteria, and 3) accounting criterion.

This post provides a view of historical and current best practice.

| Discounted Cash Flow Criteria | Payback Criteria | Accounting Criterion |

|

|

|

Note: *NPV is Preferred; Please look up basic definitions and examples for each of these capital budgeting procedures if needed.

Among these capital budgeting procedures, NPV is preferred for a number of reasons that require a much longer discussion than this one. Basically, NPV acknowledges risk, the time value of money, and cash flows beyond any set cutoff point other than years in consideration.

A look at historical use along with a brief discussion should provide enough context as to why NPV is dominant. Let’s begin.

The table below shows the historical popularity of employing a few key techniques from 1959 to 1981. One notices that NPV emerges only around 1975 and by 1981 is used 16.5% of the time. Together with IRR, these two techniques dominate, representing 81.8% of use by 1981.

| Technique | 1959 | 1964 | 1970 | 1975 | 1977 | 1979 | 1981 |

| Payback period | 34% | 24% | 12% | 15% | 9% | 10% | 5.0% |

| Average accounting return (AAR) | 34 | 30 | 26 | 10 | 25 | 14 | 10.7 |

| Internal rate of return (IRR) | 19 | 38 | 57 | 37 | 54 | 60 | 65.3 |

| Net present value (NPV) | — | — | — | 26 | 10 | 14 | 16.5 |

| IRR or NPV | 19 | 38 | 57 | 63 | 64 | 74 | 81.8 |

With increased sophistication and emerging best practices, about 75% of CFOs were always or almost always using IRR or NPV in 1999. However, it’s worth noting that payback period was used about as much as NPV and IRR among small firms.

| Technique | Always or almost always using (%) | Overall Avg Score | Large firms | Small Firms | |

| Internal rate of return (IRR) | 76 | 3.09 | 3.41 | 2.87 | |

| Net present value (NPV) | 75 | 3.08 | 3.42 | 2.83 | |

| Payback period | 57 | 2.53 | 2.25 | 2.72 | |

| Discounted payback period | 29 | 1.56 | 1.55 | 1.58 | |

| Accounting rate of return | 20 | 1.34 | 1.25 | 1.41 | |

| Profitability index (PI) | 12 | 0.83 | 0.75 | 0.88 |

Note: Scale for score was 4 (always) to 0 (never). 392 CFOs of small and large firms responding to 1999 survey.

When comparing projects, the project with the highest IRR is NOT necessarily the preferred investment! Moreover, one cannot use IRR to rank projects that are mutually exclusive. Additionally, projects with unconventional cash flows may have more than one IRR or no IRR.

That said, IRR is closely related to NPV and will lead you to the same decisions as using NPV for conventional, independent projects.

Predicting the future often leads to “soft” estimates to say the least. A variety of measures and techniques are used to determine the reliability of a given calculated NPV. While no single measure should ever be used as THE sole determining factor in these decisions, some methods are better than others.

Graham, J.R. and Harvey, C.R. “The Theory and Practice of Corporate Finance: Evidence from the Field,” Journal of Financial Economics, May-June 2001, pp. 187-244.

Moore, J.S. and Reichert, A.K. “An Analysis of the Financial Management Techniques Currently Employed by Large U.S. Corporations,” Journal of Business Finance and Accounting, Winter 1983, pp. 623-45

Ross, S. A. Westerfield, R. W. & Jordan, B. D. (2008). Fundamentals of Corporate Finance (8th edition). New York: McGraw Hill.

Stanley, M.T. and Block, S.R.”A Survey of Multinational Capital Budgeting,” The Financial Review, March 1984, pp. 36-51.

US Department of Commerce: Bureau of the Census, (2010). Annual Capital Expenditures Survey (ACES). Retrieved July 20, 2010, from http://www.census.gov/econ/aces/report/2010/capitalspendingreport2010.pdf

Posted in Uncategorized | Tagged executivePOV, ProjectSelection | Leave a Comment »

While there is great advantage to being the fresh pair of eyes in a company, one should be cautious when pointing out problems. Even if you are well intentioned, you may be perceived as calling someone’s baby ugly so to speak. And you never know the company history behind a given practice. Sometimes, problems are systemic and there is so much blame to go around progress is difficult. That’s why leadership is required to understand and inspire or persuade this particular group in a way that evolves into problem solving. This is an art.

Because assumptions can affect plans and actions from those plans, it is important to review these often combining planning with doing and reviewing almost immediately as we go (Fisher, Sharp, & Richardson, 1998). Think “fast and iterative” rather than “slow and perfect”.

A few important considerations in designing a working session include whether or not this is your first meeting with this audience in such a setting? If so, start meeting people offline with the senior most sponsor even if it’s just a walk around intro. Secondly, do you have the right people for this discussion? Are they department leads that represent the highest level of leadership over the in-focus areas? More specifically, make sure any executives between the department managers and the CEO are properly represented. Lastly, I would urge that this topic be formally on the agenda and a set amount of time has been set for this or that you introduce it and setup a special presentation/working session as a kick off of a special team.

Ok so you are either on a senior meeting agenda where you know the history of such meetings or you have setup a special working session to discuss one topic.

If this meeting really matters, there should be eight hours of preparation for every one hour of meeting you are planning. By respecting the time of the parties, you will improve the quality of interaction and control the pace of the discussion. By time bounding the exercise and being on the agenda in advance, you will be perceived as being more legitimate and professional. Additionally, the issue at hand will have the perceived sponsorship of the CEO or sponsor.

My preparations would include reviewing the meeting location and members present to make sure I have the optimal setting for the discussion. Options include table/seating configuration, so figure out if you need to conduct as a break out or need to secure a separate room prepared just for this task. Materials like flip charts, markers, ways to vote quickly, an assistant for notes, must all be thought about in advance. If working with an assistant, conduct a dry run to work out facilitator roles. You should spell out any decisions you need made and document agreements and action items for follow up.

Get a jump-start by doing some preliminary research and data gathering – emails, real customer profiles, and some numbers on how much business they represent. If possible, pick three or so real customers to represent the range of impact this perceived issue is having. Use the customer issues/cases as the reason you are discussing the topic. Think of it as a show and tell to open the working session after you have set up the facilitation of the meeting – rules, time, roles.

Now that you are ready, the stage is yours.

Some concepts to remember as you guide the discussion include these few tips I’ve learned from many years in consulting. First, your main goal is to separate fact from fantasy or to “manage by the facts”. A good approach to structured thinking is the following that helps separate general from specific and past from future action orientation. You can use this model to guide discussion and generate consensus.

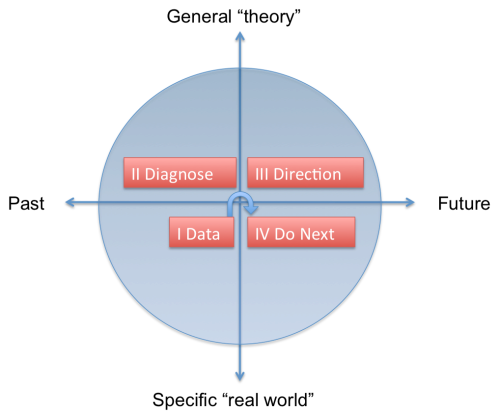

Take a flip chart and draw a simple x and y-axis so you have four quadrants – starting with 1 in the lower left and going clockwise. Use the chart to keep bullets of your discussion. Draw a large circle around the quadrants. Now, label the top of the page “theory or general” and the bottom “real world or specific”. Also, label the left side Past and the right side future. So x-axis is time and y-axis is specificity. Now consider the definition of each quadrant and use that to guide where you put points made during the discussion. These quadrants are:

Figure 1 A Structured Thinking Approach

You may want a separate chart to define the quadrants, so participants can look at it while you are working. Also, you will want at least three separate charts for noting research items and problems to address in a manner explained below. The third is a parking lot or “follow up” chart to acknowledge and defer issues outside of the discussion.

It’s good to remember that as you move from topic to topic in any presentation. The basic approach is open, focus, and close. Open is setting up the topic, focus is getting work or thinking out of the group and close is stating agreements and summarizing what was done. Keep momentum by moving on to the next point when you’ve made all the progress that is possible with the current information. This can be difficult, but you can research facilitation tools or meeting exercises to conduct. When you present the activity as an exercise, you invite participants to become self-aware and to analyze their actions.

An excellent way to think of this was explained to me by some Cap Gemini consultants. They called the activity a “problem solve / team build”. During the discussion, you establish history and then classify discussion points (what might be called issues) into either an “I wish I knew (IWIK)” or a “how to (H2)”. Each H2 spirals into it’s own discussion until you have a recommendation or a set of follow up IWIKs and/or H2s. The language keeps people in problem solving mode. I like to combine the language with the structured thinking approach offered by Fisher & Sharp where the four quadrants drive fact based consensus and the “problem solve / team build” notes are “drill downs” into a topic. Manage breakout sessions as appropriate to best leverage the participants.

If you set some rules of the meeting to discuss the issue in this manner, you can guide the discussion in an open, focus, close manner until you reach some consensus understanding of what needs to be done next. Now that you have established history by introducing observations backed by the preliminary research you did as preparation and conducted a time-boxed exercise to generate some problem solving, you are ready to close the exercise.

When closing, review the actions and agreements and close by setting a next meeting date to review progress. For actions, you will need to define who will do what by when and with what resources. Sometimes, you might clarify the deliverable format. Get a commitment from the person responsible for a completion date or at least a date to get a completion date. This is an internal meeting; consider sensitivity where actions will require external company interactions. Most likely, each IWIK will become a simple research item that upon completion the group will benefit from learning the results. The H2s will become issues, risks, assumptions to monitor or design considerations for the eventual solution.

Issue minutes with at least agreements and action items. This can be how you get people to be responsible and committed. You will have to follow up with each and be mindful of when you follow up one on one versus as a group. You need to reinforce your role in facilitating this special team and use this group to get official resources where needed from each group.

Until, unless you are part of a program I suggest that the host of a meeting is responsible for tracking and driving follow up on action items (research, and other problem solve sessions). Basically, track what you create/inspire because you don’t want examples of things you didn’t finish floating around.

So these meetings were internal, but no company operates in a vacuum. You need to review how supplier/vendor relationships are managed and act accordingly. Include this group if possible or sketch out how the team should work with external parties. Legal may have concerns and you can ask for guidelines from legal, but do not create a gate through legal that will slow down everything. Use them for advice to mitigate risk to company such as providing a list of guidelines to share with the group. This is especially true for strongly regulated industries.

Remember that by owning the definition of the critical business issue and possibly defining the relevant critical process issue, vendors may be threatened or see opportunity and you will have to be careful to drive definition in a fact based manor that is not overly influenced by vendor objectives that may not be readily apparent at first.

Also, consider emotions throughout your work. Much of problem solving is negotiation of roles. Expect negative emotions and have plans for managing emotions (Fisher & Shapiro, 2005).

IF the current state of practices is unknown, I would wait on addressing ethical concerns. There is an old saying, “the chord wood always screams as it’s being carried to the fire”. Be mindful of how threatening these activities can be and seek to include or at least inform when the team is ready to expand it’s efforts. Again, avoid early changes to organizational structures. You may inadvertently mask root causes or introduce new problems further complicating an already complex problem.

IF applicable, the sensitive issue of ethical considerations should be identified as part of the research findings while deepening collective understanding and assessment of the situation.

Create a risk plan and review your risk mitigation strategies often during the early part of the work. An independent survey or audit may be in order to supplement the team’s work. However, focus should be on resolving the customer impacting quality issues. By focusing on problem solving, we can mitigate conflict that might arise to sensitive issues (Robbins & Judge, 2007). What’s important is the impact to the company and (as we used to say at Amdocs) the effect on the “intentional customer experience.”

The best long-term impact is to remain personally committed and to stress this area wherever possible. Off line discussions should be had over time with all the key leadership to understand the leadership landscape. Again, focus on root cause analysis and results. Then, with an increasingly credible voice raise other concerns. This will become easier as you become a more trusted advisor. Lastly, avoid only providing good news. Finally, remember that when you raise integrity issues, your own integrity may be called into question

– be ready.

Fisher, R., Sharp, A., & Richardson, J. (1998). Getting it done: how to lead when you’re not in charge. New York: HarperBusiness.

Fisher, R. & Shapiro, D. (2005). beyond reason: Using Emotions as You Negotiate. Penguin Group. New York, New York.

Robbins, S.P., & Judge, T.A. (2007). Organizational Behavior (12th ed.). Upper Saddle River, N.J.: Pearson Prentice Hall.

Posted in Uncategorized | Tagged consultingPractices, executivePOV, lessons | Leave a Comment »

Wisdom is best exchanged between people. In fact, some Native Americans still believe writing something down makes it less sacred. Having said that, let me attempt to share this anyway.

While this case is political, the goal is objective discussion about a significant historical executive point of view – in this case, a former member of two U.S. Presidential Cabinets. This post’s challenge is “What are the business lessons or parallels for today’s environment?”.

Believe it or not, we begin with a movie recommendation.

In February of 2004, director Errol Morris released an academy award winning documentary called “The Fog of War: Eleven Lessons from the Life of Robert S. McNamara. McNamara was the 8th United States Secretary of Defense and served in office from January 21, 1961 – February 29, 1968 under JFK and LBJ. Rent the movie, the lessons and parallels for today are striking.

An interesting note is that the lessons in the movie are different from the lessons McNamara wrote. Try comparing these and approaching with an open mind to McNamara’s reputation.

The Fog of War’s 11 lessons

Robert S. McNamara’s Original Ten Lessons (and basis for the movie)

Executive leaders have long drawn lessons from military science. Please leave a comment.

“What are the business lessons or parallels for today’s environment?”

Posted in Uncategorized | Tagged executivePOV, history, lessons, military | 2 Comments »